By: John Adams, Principal and Head of Investment Banking

National Economy

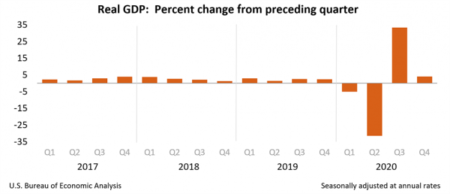

Real gross domestic product (GDP) increased at an annual rate of 4.0% in the fourth quarter of 2020 (table below), according to the “advance” estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 33.4%.

The GDP estimate released today is based on source data that are incomplete or subject to further revision by the source agency. The “second” estimate for the fourth quarter, based on more complete data, will be released on February 25, 2021.

Real GDP: Percent change from preceding quarter, Q4 ’20

The increase in real GDP reflected increases in exports, nonresidential fixed investment, personal consumption expenditures (“PCE”), residential fixed investment, and private inventory investment that were partly offset by decreases in state and local government spending and federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The increase in exports primarily reflected an increase in goods (led by industrial supplies and materials). The increase in nonresidential fixed investment reflected increases in all components, led by equipment. The increase in PCE was more than accounted for by spending on services (led by health care); and spending on goods decreased (led by food and beverages). The increase in residential fixed investment primarily reflected investment in new single-family housing. The increase in private inventory investment primarily reflected increases in manufacturing and in wholesale trade that were partly offset by a decrease in retail trade.

Current‑dollar GDP increased 6.0% at an annual rate, or $309.2 billion, in the fourth quarter to a level of $21.48 trillion. In the third quarter, GDP increased 38.3%, or $1.65 trillion. The price index for gross domestic purchases increased 1.7% in the fourth quarter, compared with an increase of 3.3% in the third quarter. The PCE price index increased 1.5%, compared with an increase of 3.7% in the third quarter. Excluding food and energy prices, the PCE price index increased 1.4%, compared with an increase of 3.4%.

Personal Income

Current-dollar personal income decreased $339.7 billion in the fourth quarter, compared with a decrease of $541.5 billion in the third quarter. The decrease in personal income was more than accounted for by decreases in personal current transfer receipts (notably, government social benefits related to the winding down of CARES Act pandemic relief programs) and proprietors’ income that were partly offset by increases in compensation and personal income receipts on assets.

Disposable personal income decreased $372.5 billion, or 8.1%, in the fourth quarter, compared with a decrease of $638.9 billion, or 13.2%, in the third quarter. Real disposable personal income decreased 9.5%, compared with a decrease of 16.3%.

Personal saving was $2.33 trillion in the fourth quarter, compared with $2.83 trillion in the third quarter. The personal saving rate—personal saving as a percentage of disposable personal income—was 13.4% in the fourth quarter, compared with 16.0% in the third quarter.

GDP for 2020

Real GDP decreased 3.5% in 2020 (from the 2019 annual level to the 2020 annual level), compared with an increase of 2.2% in 2019. The decrease in real GDP in 2020 reflected decreases in PCE, exports, private inventory investment, nonresidential fixed investment, and state and local government that were partly offset by increases in federal government spending and residential fixed investment. Imports decreased.

The decrease in PCE in 2020 was more than accounted for by a decrease in services (led by food services and accommodations, health care, and recreation services). The decrease in exports reflected decreases in both services (led by travel) and goods (mainly non-automotive capital goods). The decrease in private inventory investment reflected widespread decreases led by retail trade (mainly motor vehicle dealers) and wholesale trade (mainly durable goods industries). The decrease in nonresidential fixed investment reflected decreases in structures (led by mining exploration, shafts, and wells) and equipment (led by transportation equipment) that were partly offset by an increase in intellectual property products (more than accounted for by software). The decrease in state and local government spending reflected a decrease in consumption expenditures (led by compensation).

The increase in federal government spending reflected an increase in nondefense consumption expenditures (led by an increase in purchases of intermediate services that supported the processing and administration of Paycheck Protection Program loan applications by banks on behalf of the federal government). The increase in residential fixed investment primarily reflected increases in improvements as well as brokers’ commissions and other ownership transfer costs.

Current-dollar GDP decreased 2.3%, or $500.6 billion, in 2020 to a level of $20.93 trillion, compared with an increase of 4.0%, or $821.3 billion, in 2019.

The price index for gross domestic purchases increased 1.2% in 2020, compared with an increase of 1.6% in 2019. The PCE price index also increased 1.2% in 2020, compared with an increase of 1.5%. Excluding food and energy prices, the PCE price index increased 1.4%, compared with an increase of 1.7%.

Measured from the fourth quarter of 2019 to the fourth quarter of 2020, real GDP decreased 2.5% during the period, compared with an increase of 2.3% during 2019.

The price index for gross domestic purchases, as measured from the fourth quarter of 2019 to the fourth quarter of 2020, increased 1.3% during 2020. That compared with an increase of 1.4% during 2019. The PCE price index increased 1.2%, compared with an increase of 1.5%. Excluding food and energy, the PCE price index increased 1.4%, compared with an increase of 1.6%.