By Rick Elton, Managing Director of Sheshunoff & Co., Investment Banking

Global equity markets closed out their most brutal first half of a year in decades with accelerating inflation and rising interest rates fueling a June 2022 rout that left few markets unscathed. The S&P 500 declined by about 21% during the first six months of the year (8.4% decline during the month of June), suffering its worst first half loss of a year since 1970, according to Dow Jones Market Data.

As inflation levels remain near 40 year highs, the Federal Reserve increased interest rates by 0.75% in June, the biggest rate increase since 1994, with another 0.75% increase currently anticipated at its July meeting. After the Fed fell behind the inflation curve, they have had to play catch-up in the form of interest rate hikes worth 1.50%, with more to come. After mounting one of its fastest increases in history to start 2022, the 10-year U.S. treasury yield has in recent weeks retreated from an end-of-day high of 3.482% reached on June 14, 2022, reflecting a dimming view of the economy. The 10-year U.S. treasury yield ended June 30, 2022 at 2.973%, benefiting from the rocky stretch in equities, leaving most indices in bear market territory.

Although current labor markets remain strong, slowing home sales and record-low consumer sentiment have added to concerns that soaring costs for necessities like gasoline and food are catching up with household budgets. Oil prices surged above $100 a barrel with U.S. gas prices hitting records as the Russia-Ukraine war upended imports from Russia, the world’s third largest oil producer.

Mortgage rates declined during the last week of the quarter but remain near multi-year highs, helping make it the least affordable time to purchase a home since before the financial crisis. The average rate on a 30-year fixed-rate mortgage ended the quarter at 5.70%, up from 3.22% to start the year, according to Freddie Mac.

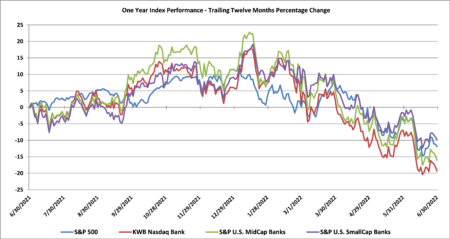

The KBW Nasdaq Bank Index posted a 17.5% decline during the second quarter of 2022 compared with the 6.1% decline in the first quarter of 2022. This index is now down by 19.3% over the past year and up by only 3.1% over the past three year period. By comparison, smaller banks posted slightly better returns during the second quarter of 2022, with the S&P U.S. SmallCap Bank index decreasing by 14.2% in the quarter with the index being down by 9.7% over the past year while posting a three year rise of 6.9%. The S&P U.S. MidCap Bank index declined by 18.3% during the second quarter of 2022 compared to the decrease of 7.4% during the first quarter of 2022 leaving it down by 16.0% over the past year and up by 13.0% over the past three years. By comparison, the S&P 500 was down by 16.5% during the second quarter of 2022 leaving it down by 11.9% during the past year. The S&P 500 was up by approximately 28.7% during the past three year period compared to the 3.1% rise for the KBW Nasdaq Bank Index and the 37.8% increase in the technology heavy Nasdaq. The Nasdaq decreased by 22.4% during the second quarter of 2022 and was down by 24.0% over the past year.