By Rick Elton, Managing Director of Sheshunoff & Co., Investment Banking

Stocks head into the fourth-quarter of 2025 at record highs, with September having been the historically weakest month for stocks, but not in 2025. In fact, the entire third quarter has been a treat for investors, with U.S. equities marching to new highs and bouncing back from April’s tariff tiff. But markets are now bracing for a government shutdown after Trump and Republicans met with Democrats in the Oval Office on Monday, September 29th, but failed to strike a deal to avert a halt to funding. “I think we’re headed to a shutdown,” Vice President JD Vance said.

Most of that optimism came as Q2 earnings surprised to the upside, the AI-fueled trade continued to gain momentum, and investors piled on the bets that the Federal Reserve would cut rates. Compounding existing excitement, earnings growth is expected to continue, AI optimism continues with no clear ceiling, and investors finally have the cut they were looking for. But that’s not to say that there aren’t concerns. Equities are now considered “expensive” across several measures, the economy seems to be teetering, and a government shutdown could delay the release of critical economic data at a time where the Federal Reserve desperately desires those insights. The concern is that the government’s economic data releases will halt during the government shutdown. The Bureau of Labor Statistics will “completely cease operations” if it happens, the Department of Labor said, likely delaying the release of the October 3rd non-farm payrolls report among other top-tier data crucial to the Federal Reserve’s policy setting. Meanwhile, Trump sent out a fresh flurry of tariffs on lumber, timber, and certain types of furniture late Monday, September 29th, hot on the heels of a threat of levies on foreign-made movies and last week’s plan to put 100% duties on branded drugs. Concerns are growing about the impact on the global economy from Trump’s ever-expanding trade offensive, after new data showed China and Japan’s factories are still caught in a slump.

All four equity benchmarks notched new record highs, including the Russell 2000, which emerged from a years-long rut by setting its first record high since Nov. 2021 on rate cut optimism. It was the best-performing of the major benchmarks during the third quarter, up by 12.0%. However, there were still envious performances for the large cap-focused S&P 500 (up by 7.8% in the quarter) and Nasdaq Composite (up by 11.2% in the quarter), which had their best third quarter since 2020 and best September since 2010. And even the 30-strong Dow Jones Industrial Average, the worst performing among major U.S. equity benchmarks, finished the quarter at a record high (up by 5.2% in the quarter). It was its 8th of the year, with all of them coming since August 22, 2025.

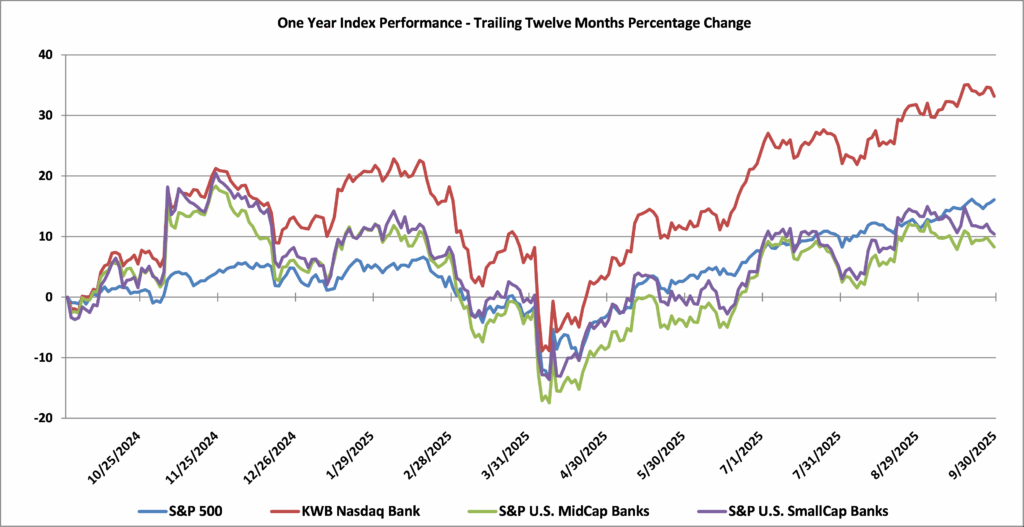

Bank stocks, although volatile at times, moved higher early in the third quarter and then softened late in the quarter, generally matching the returns for the broader market in the third quarter. Bank stocks ended in positive territory over the past year. The KBW Nasdaq Bank Index posted a 9.2% increase during the third quarter of 2025 (up by 1.1% in September) compared with a rise of 14.0% in the second quarter of 2025. This index was up by 33.2% over the last twelve months and up by 59.1% over the past three-year period. By comparison, smaller banks posted lower returns during the second quarter of 2025, with the S&P U.S. SmallCap Bank index increasing by 6.0% in the quarter (down by 3.2% during the month of September) with the index being up by 10.4% during the past year while posting a three-year rise of 18.0%. The S&P U.S. MidCap Bank index increased by 4.6% during the third quarter of 2025 (down by 3.3% in September) compared to the increase of 6.7% during the second quarter of 2025 leaving it up by 8.3% over the past year, but down by 9.0% over the past three years. By comparison, the S&P 500 was up by 7.8% during the third quarter of 2025 leaving it up by 16.1% during the past year. The S&P 500 was up by approximately 86.5% during the past three-year period compared to the 59.1% increase for the KBW Nasdaq Bank Index and the 114.3% increase in the technology heavy Nasdaq. The Nasdaq increased by 11.2% during the third quarter of 2025 and was up by 24.6% over the past year.