Market Write-up- Second Quarter 2025 Stock Market Write Up

Stocks head into the third-quarter of 2025 at record highs, but the second half of an eventful 2025 begins with attention squarely on the budget “vote-a-rama” in Washington, D.C. Major indexes reached all-time highs at the end of the second quarter that came courtesy of falling yields, trade optimism, and information technology power. Beyond the Senate, investors will monitor trade updates, job openings, manufacturing data, and Federal Reserve Chairman Jerome Powell public comments as he faces fresh pressure from Trump to cut rates.

Over the weekend of June 21-22, conflict in the Middle East escalated, as the U.S. launched airstrikes against three of Iran’s nuclear-enrichment facilities. This was a surprise strike and came in the midst of Israel and Iran’s ongoing conflict that began on June 13. However, late in the quarter there has been notable de-escalation in the conflict. While Iran retaliated against the U.S. at its base in Qatar, there were no casualties and no material damage. As a result of the easing geopolitical tensions, oil and energy prices have fallen substantially over the last week of the quarter. For example, U.S. WTI crude oil, which had risen over 20% in June to $75 per barrel, fell about 13% last week down to around $65 per barrel. This move lower in oil prices is not only supportive for consumers, but also a positive for keeping inflationary pressures contained. The fall in oil and energy has appeared to support market sentiment late in the quarter, helping drive equity markets to new highs.

Another catalyst that has boosted stocks is likely centered around the prospects of lower interest rates by year-end. The Federal Reserve at its June 17-18 meeting outlined potentially two rate cuts in 2025 in its updated “dot plot,” or best estimate of the fed funds rate. It also continues to show ongoing rate cuts in 2026 and 2027, with a longer-term fed funds rate of 3.0%, well below today’s 4.25% – 4.5% rate. While the Fed acknowledges that there is uncertainty around this projection, especially with tariffs adding uncertainty and potentially putting upward pressure on inflation in the near term, it appears the market’s view is that the Fed remains on track to move short-term interest rates gradually lower. Also, recent consumption measures appear to point to softening as well. Retail sales for May came in below expectations on a headline basis, and last week’s personal spending data for May turned negative as well. These datapoints indicate some potential softening in consumer spending in recent weeks.

Markets are now pricing in two or three rate cuts in 2025, according to CME FedWatch. Treasury yields across the curve have moved lower, with both 2-year and 10-year yields well below highs from earlier this year. These moves lower in interest rates are positive for consumers and corporations and supportive of better stock-market sentiment broadly, but could change as news of trade negotiations hit the market. Investors are awaiting the announcement of any trade deals between the U.S. and its trading partners, as Trump’s 90-day tariff reprieve is set to expire in early July. On the last day of the second quarter, Treasury Secretary Scott Bessent said there are “countries that are negotiating in good faith.” However, he added that “if we can’t get across the line because they are being recalcitrant,” tariffs could still “spring back” to the levels announced on April 2.

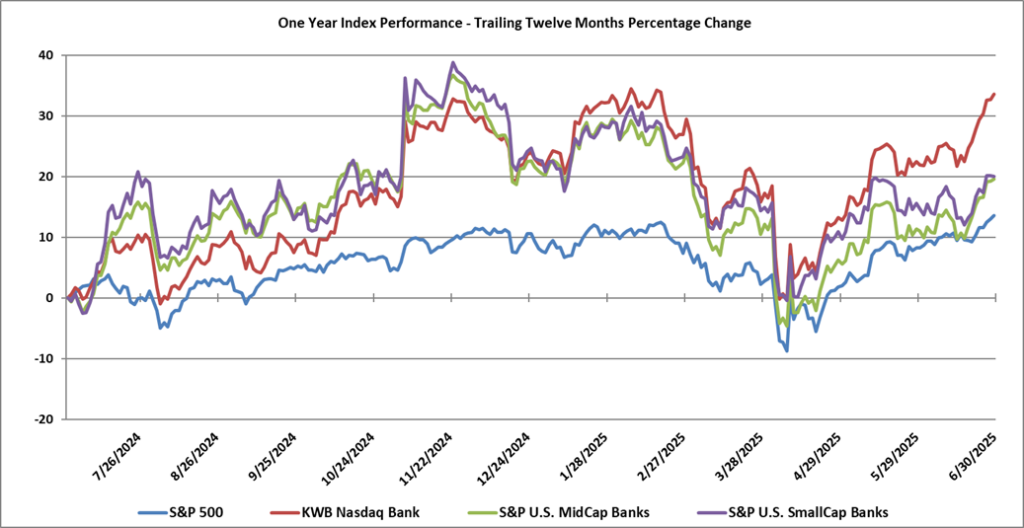

Bank stocks, although volatile at times, drifted lower early in the first quarter and then rallied late in the quarter, and managed to post higher returns than the broader market. Bank stocks ended in positive territory over the past year. The KBW Nasdaq Bank Index posted a 14.0% rise during the second quarter of 2025 (up by 9.6% in June) compared with a decline of 3.9% in the first quarter of 2025. This index was up by 33.6% over the last twelve months and up by 38.3% over the past three year period. By comparison, smaller banks posted lower returns during the second quarter of 2025, with the S&P U.S. SmallCap Bank index increasing by 4.5% in the quarter (up by 4.7% during the month of June) with the index being up by 20.1% during the past year while posting a three-year rise of 12.8%. The S&P U.S. MidCap Bank index increased by 6.7% during the second quarter of 2025 (up by 7.7% in June) compared to the decrease of 7.0% during the first quarter of 2025 leaving it up by 19.7% over the past year, but down by 14.5% over the past three years. By comparison, the S&P 500 was up by 10.6% during the second quarter of 2025 leaving it up by 13.6% during the past year. The S&P 500 was up by approximately 63.9% during the past three-year period compared to the 38.3% increase for the KBW Nasdaq Bank Index and the 84.7% increase in the technology heavy Nasdaq. The Nasdaq increased by 17.8% during the second quarter of 2025 and was up by 14.8% over the past year.