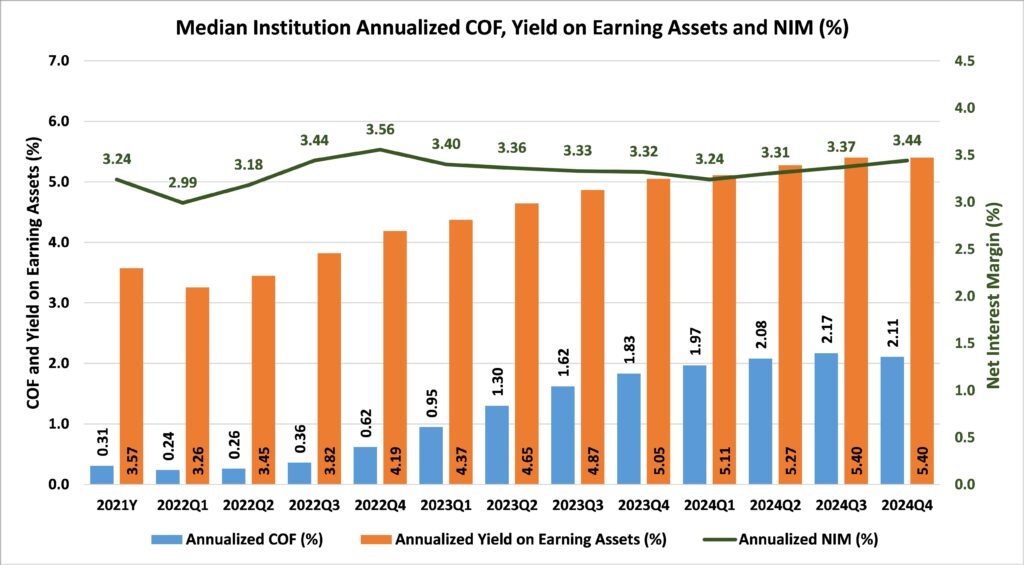

As banks have been able to increase or maintain their yields on earning assets, the easing of funding costs has resulted in higher net interest margins. As shown in the graph above, banks have had success stabilizing earning asset yields while funding costs have moderated, allowing for a positive impact on net interest margins during 2024. The median bank in the U.S. saw its quarterly annualized earning asset yield remain at 5.40% in the fourth quarter of 2024, consistent with the annualized yield of 5.40% during the third quarter of 2024, with net interest margins increasing slightly to 3.44% in the fourth quarter from 3.37% in the third quarter of 2024. Additionally, the median U.S. bank experienced an annualized cost of funds of 2.11% in the fourth quarter of 2024, down from 2.17% in the third quarter of 2024.

Now is the time for community banks to consider their long-term strategic capital and liquidity plans. What is your next move as deposit costs moderate? Would an acquisition of a highly liquid bank transform your balance sheet and unlock shareholder value? Let Sheshunoff help you with your next strategic initiative.